While we recently saw the 75,000-point Southwest personal card offers go away, the good news is that it’s still easy to earn the Southwest Companion Pass!

Right now, you can still earn this pass, which lets one person fly free with you for up to two years, was already SIMPLE to earn, in just TWO steps. AMAZING!

I’m going to explain how…

By applying for BOTH Southwest business credit cards (you CAN hold both business cards, but only 1 Southwest personal card) 30 days apart and then meeting the minimum spend for each, you will have earned more than the 135,000 Southwest points required to earn your pass.

2 steps done!

But I Don’t Have a Small Business, So It Doesn’t Apply to Me… Wrong!

Nearly anyone can qualify for a business card.

Any sort of side income can be used to earn a business card, even if it’s just as a sole proprietor using your SSN. Think selling used furniture on Facebook Marketplace or books on eBay, recharging Lime scooters, walking dogs, babysitting etc.

Are any of these something you could start doing if you aren’t already?

You really only need to have the “intention” to earn a profit with a side business to be eligible for a business card. And you can do so using your own social security number.

I advise getting a FREE EIN # from the IRS, as that usually provides any additional paperwork that Chase may ask to see.

Download our FREE “Ultimate Guide to Earning a Small Business Card,” which has step-by-step details, including how to fill out the online application, below…

You’re good… I promise! 🙂

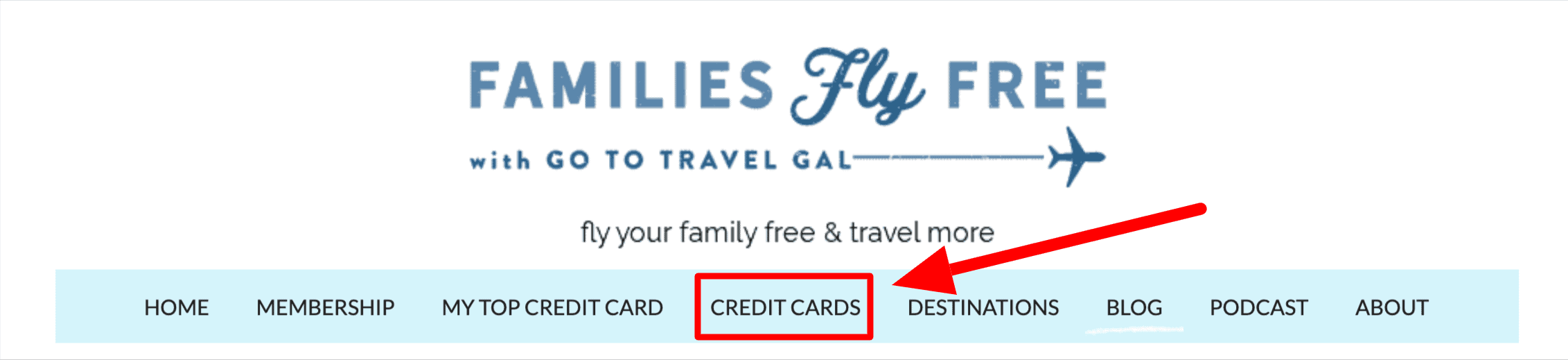

Note: To apply for the credit cards included in this post, please use the links within this post or click on TRAVEL CREDIT CARDS on the main menu shown in the image below (choose Airline). This allows us to earn a commission — at no cost to you — to help support the blog and our free content. I sincerely appreciate you taking this step!

Want to ensure you don’t make any mistakes earning the pass? Be sure to download my 10 Things You MUST Know to Earn the Southwest Companion Pass tip sheet below…

NOW Is the Best Time of Year to Earn the Southwest Companion Pass!

An ideal scenario is to earn the Southwest Companion Pass as early in the year as possible.

This is because is is VALID from the time you earn it until the END of the following year (that would be Dec. 31, 2022).

If you earn it NOW, it will be good for almost TWO full years, so go for it!!

How to Earn the Southwest Companion Pass in 2 Simple Steps

First, you’ll need to know these Southwest credit card rules before trying to apply for ANY of their cards:

- Each person can only hold ONE personal Southwest card.

- You are not eligible to earn a bonus on a Southwest personal card if you’ve earned a bonus on ANY personal Southwest card ONCE in the last 24 months. If this rules you out, consider applying for TWO Southwest business cards (you CAN hold BOTH business cards) or having a spouse or loved one take advantage of this offer.

- You can hold BOTH business cards (which is different than the personal card rule).

- Chase will not approve you for ANY card if you have opened 5 or more new cards of ANY type in the last 24 months (excluding Chase, AMEX and Citi business cards).

- Chase will not approve you if you apply for more than one of their cards within 30 days. An exception to this rule, which some readers have had success with, may be if you bank with Chase and go into a branch to apply.

Step 1: Apply for Southwest Performance Business

Your first step is to apply for the Southwest business card with the highest offer AND the most benefits: Southwest Performance Business.

Southwest Performance Business ($199 annual fee) currently has a 80,000-point bonus after a $5,000 minimum spend in 3 months.

This card has LOTS of benefits, but I especially love that it earns more points on phone, cable and Internet expenditures AND its four A1-15 upgraded boarding orders yearly! Read about its benefits.

Once you meet the minimum spend, you’ll have 85,000 points (80,000 points for meeting the minimum spend + another 1 point per $1 for your $5,000 minimum spend).

Step 2: Apply for Southwest Premier Business (at least 30 days later)

Your next step is to apply for Southwest Premier Business.

Wait at least 30 days between card applications, as Chase will only approve you for one of their cards every 30 days.

This card has a $99 annual fee and currently has a 60,000-point bonus after a $3,000 minimum spend in 3 months. Its only real benefit is no foreign transaction fees. We really only want it for its sign-on bonus points :).

You can read complete details and benefits about Southwest Premier Business here.

Once you meet the minimum spend on this card, you’ll have another 63,000 points (60,000 points for meeting the minimum spend + another 1 point per $1 for your minimum spend).

That totals 138,000 points, which is 13,000 points MORE than you need to get your Southwest Companion Pass (125,000 points).

Easy peasy!

Meeting the Minimum Spends

Make sure you can responsibly meet the minimum spend without going into debt and take it slower than 30 days apart if you need. Flying free is no longer a good deal if you are paying a super high interest rate on balances!

Read my post on creative ways to meet the minimum spend on a Southwest credit card.

I like to use a service like Plastiq (this is an affiliate link) that lets you pay bills you ordinarily can’t pay with a credit card (note: you can’t pay a mortgage with Plastiq) with a credit card in order to help quicky knock down a minimum spend. You can even pay your taxes with Plastiq!

In the Chase app, they now have a feature that tracks how close you are to meeting the minimum spend for each card. Very handy!

The points will credit to your account AFTER the closing date of the time period in which you meet the minimum spend or possibly after the SECOND closing date after the time period in which you met the minimum spend (some readers have reported that of late).

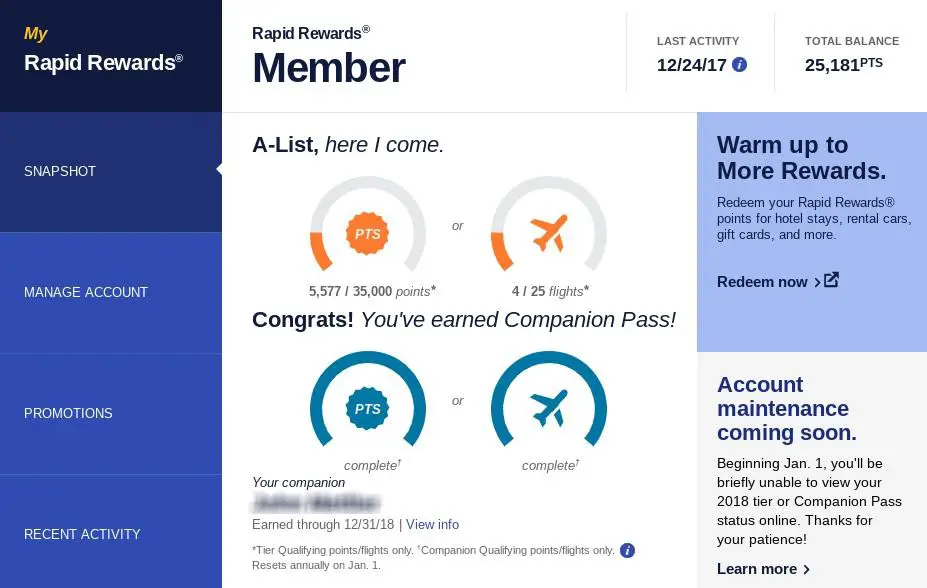

Get Your Southwest Companion Pass!

Southwest should email you that you have reached Companion Pass status once all of your points have credited! You can also go to Southwest.com and click on My Account, which will show you your current status. Then simply call Southwest to choose who your Companion will be.

Keep in mind that not only do you have the Pass, but you now have 138,000 Southwest points to spend booking FREE FLIGHTS! You can use these points AS SOON AS YOU EARN THEM to book free flights; they will still qualify for the Companion Pass.

By combining the Southwest Companion Pass with earning tons of Southwest points, my family of four has been able to fly almost entirely free around the U.S. since fall of 2015. It’s incredible! Here’s how the Companion Pass has changed my life.

What Do I Do If I’m Declined?

Here’s what to do if you are declined: Call the Chase reconsideration line to find out why.

It’s often because you applied for more than 1 card in 30 days or they want to see some simple additional paperwork for the business card.

See my recommendation about the free EIN number from the IRS above. That usually suffices for the paperwork they want to see. Download the PDF and send it to them and 9 times out of 10, you’re good!

Sometimes it’s because they don’t want to extend you any more credit from Chase. If that’s the case, ask if you can close another card or reduce a credit line on a different card and extend it to this one.

Don’t worry if you are declined. It’s happened to us twice, and we were eventually approved both times. Keep your end game in mind: the Companion Pass!

Are There Any Costs Associated With This Process?

Yes, but they are minimal when spread across two years or multiple flights. They include:

- $5.60 per person per way mandatory government security fee

- $99+$199 annual fees for each credit card = $298

That’s it! A heckuva deal! The Southwest Companion Pass can easily save you thousands over the course of two years depending on how much you travel.

With the average cost of a flight in the US around $350, you’re saving that EVERY time you bring someone to fly free with you.

Who’s going for the Southwest Companion Pass by taking advantage of these offers? Shout it out!

What to Do If You Have Questions About Earning a Southwest Companion Pass

Got questions about if you’re eligible for a business card or how to earn the Southwest Companion Pass? You’re not alone!

Thanks again for starting your credit card applications using the links within this post or at the TRAVEL CREDIT CARDS link in the main menu above (choose Airline).

Read More:

- 7 Ways to Use the Southwest Performance Business Card Bonus

- 10 Reasons to Get the Southwest Priority Card

- The Ultimate Guide to Earning the Southwest Companion Pass

- Top 10 Southwest Companion Pass FAQs

- The Latest Posts on How to Earn Rapid Rewards Points

Author

-

Lyn Mettler is a longtime travel writer for US News & World Report, USA Today 10Best and The TODAY Show who created Families Fly Free, a program which teaches families her simple system to use travel rewards to fly for free.